Companies : Plan Ahead Your Climate- Related Disclosures

Key words: Climate related disclosures, New IFRS standards

By Miia Chabot, Research & Development Director

28/03/2022

One of the biggest challenges for companies now is their ability to evaluate and disclose their exposure to risks and opportunities related to climate change. This requires them to have a clear understanding of the way in which climate affects their value chain. This is especially important as regulators are increasingly calling for greater transparency, and more particularly, as disclosure is becoming a requirement for G20 countries.

The leading country is the UK[1], where more than 1300 of the UK’s largest companies and financial institutions will be required to disclose detailed reports from April 6, 2022[2]. From this date, companies will have to disclose comprehensive reports, drawing on the recommendations of the Task Force on Climate-Related Financial Disclosures[3] (TCFD).

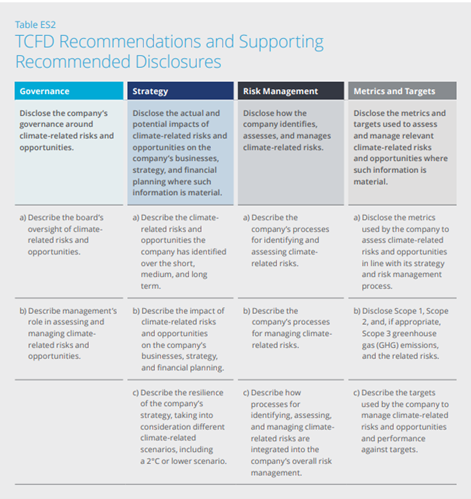

This will not simply be a matter of measuring targeted risks and/or assessing carbon impact. This will involve the ability at all levels of the company to carry out an assessment of climate exposure by examining the governance, the strategy, climate risk management, and to reveal which instruments (metrics and targets) are used for this end.

Until recently, the TCFD recommendations were discretionary: companies were left to decide whether or not to disclose information. Now that this has become a requirement, it is a different story. Indeed, this duty is a game-changer: the information will allow to assess the company’s resilience and its role in the effort to tackle climate change. This information will also be used during audits. Yet the TCFD only broadly outlines what should be available in a report, as shown in the table below.

The British are thus pioneers in this area. And the task is not straightforward. Many questions remain, both on the form that this kind of report can take as well as on its content. For we can only manage what we can measure, and because the measurement issue is far from being solved. To mention just one example, in the previous table, there is no clear distinction between what is physical risk and what is transition risk. These two risks do affect the company’s activity in very different ways. So how will this information be incorporated into the upcoming reports?

The developments that will take place in the coming months in the UK will surely tell us a lot about methods and solutions that companies will implement for climate disclosure. However, keeping a watching brief would not be a good strategy. The trend is on the move and it has become necessary for all G20 countries that are not yet subject to this obligation to prepare for it.

But what standards do we really need to adopt? What should a climate disclosure report really look like? Do we need to focus on the TCFD’s recommendations, or do we need to wait, as some suggest, until the official release of new IFRS standards?

Actually, the IFRS prototype is already in place[4], and it is well advanced, following the same rationale as the recommendations made by the TCFD (IN7). It thus includes the four blocks of the previous table. There are, however, some further details and this time, the recognition of physical and transition risks is made explicit.

The goal is obvious. The purpose of the report is to determine the effects of climate-related risks and opportunities on the entity’s financial position, financial performance and cash flows. It must be a guide to the understanding and assessment of the entity’s enterprise value. The report needs to show how the management uses its resources in response to climate change. It must reveal the ability of the entity to adapt its planning, business model and operations in response to climate change.

Based on this, the prototype identifies the disclosures required by industry type and the metric(s) that should be used to do this (Appendix B). These breakdowns vary considerably from one sector to another. With this new nomenclature, we can better focus on the issues of importance to a company when preparing its reporting. So, why wait any longer?

The fact is that the work involved in preparing such a report is huge. It requires recruiting new skills within the company, rethinking its organization, fostering synergies among teams, facilitating information and being flexible. It will require us to move far beyond CSR approaches, to think more broadly about ESG and to be more proactive in the face of climate change.

To support this change, advisory companies will be key pillars to rely on. Weatherisus’ expertise in risk management, metrics, and climate-related goals, along with its location in both England and France, can truly support your disclosure journey. More information on our work.

Read more about our work:

By Dr. Jean-Louis BERTRAND – Feb, 8, 2024

By Dr. Miia CHABOT- October 2022

By Dr. Miia CHABOT- 27/03/2022

[1] UK Gov., 2021, UK to enshrine mandatory climate disclosures for largest companies in law, Press Release

[2] Gado S., Wex S., Lewy M., 2021, New Mandatory climate-related financial disclosures for large UK Businessess, Womble Bond Disckinson.

[3] https://www.fsb-tcfd.org/publications/, Statuts Report Oct. 2021

[4] TRWG, ISSB, (2021), Climate- Related Disclosures Prototype, chaired by the IFRS Foundation.

About the authors

Founded in 2019 by a team of corporate risk management experts and climate scientists, Weatherisus operates from Angers and London, offering data-driven analysis and advice, and financial protection against climate risks.

We engage with companies to identify the climate risks they face

From supply chain to sales to end customers, we analyze these risks based on companies’ business data and our own databases, define the specific characteristics of each climate risk, and assess the short- and medium-term financial consequences to facilitate decisions.